As the impact of the Covid-19 global pandemic becomes apparent, CFOs are working closely with their real estate teams to re-assess workspace costs both now and in the future.

In our discussions with global clients over the past few weeks, the key issue being referred to is the future footprint. There is clear sense among CRE leaders that the pandemic has irreversibly changed how future space needs will be calculated.

One global bank suggested they would look to cut their fixed footprint by 70-80% when lease events allow over the coming years, and others are voicing 50-60% reductions.

As one global law firm client, based in Hong Kong, said recently:

“The one major shift that I can foresee is that the current Corona virus outbreak will have long term ramifications on how businesses assess their future premises requirements.

“We have successfully operated with less than 10% of people in the office for over a month with the balance of people working from home – so what amount of office space do businesses really require and will they be willing to forego the potential cost savings by maintaining the traditional model? So how flexible working space can meet this potential change in approach will be key.”

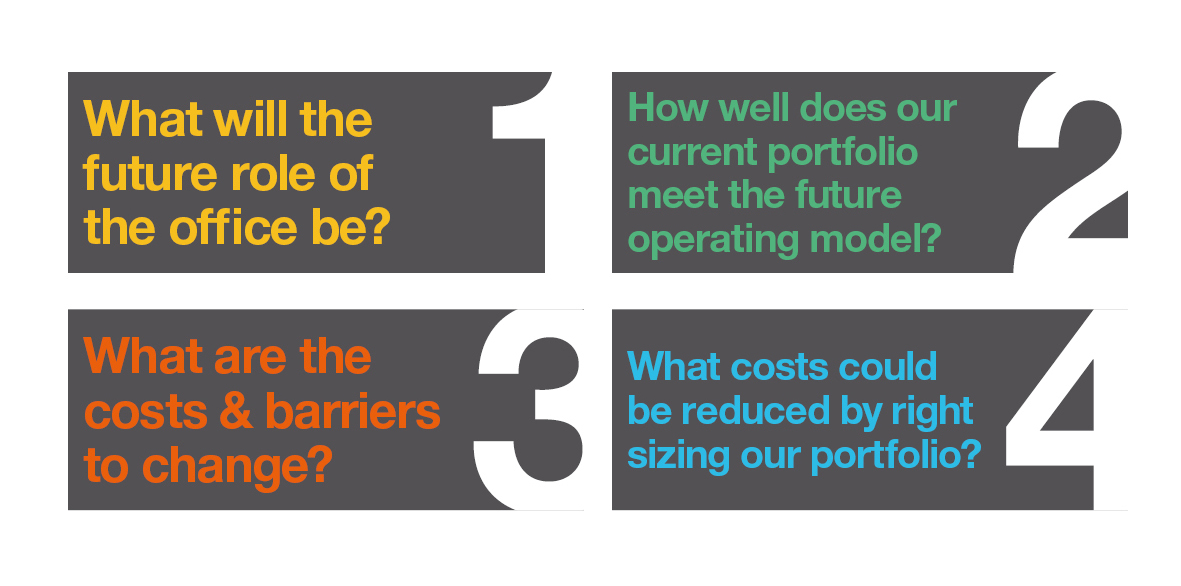

CFO’s and their CRE functions will now be grappling with:

- What will the future role of the office be?

- How well does our current portfolio meet the future operating model? (Location, size, functionality, flexibility etc)

- What are the costs and barriers to change

- What costs could be reduced by right sizing our portfolio?

The immediate priority for the vast majority of finance teams focused on workspace is cost saving. But a critical element of the cost mitigation process is ensuring that office portfolios have a sufficient element of flexibility and speed to respond now built into them. This COVID-19 Pandemic is now showing the critical requirement of being able to flex down as required, to relinquish long leases that tie up resources and slow down business. With the number of workspace options available to business that do not require signing a lease and carrying self-delivery of workspace services, it would seem an inevitable outcome of post-Pandemic strategy to move to a more agile model for workspace delivery and management.

The second key consideration will be how they grow their businesses back up when the markets do come back up. Being able to react at pace will be critical given the current inability of either government or business to predict the full impact and time period of the Covid crisis. Many CFOs will now be shifting their CRE teams focus to rebuilding and understanding what the “new normal” looks like from the perspective of geographic dispersal, remote working bias, and utilization of space.

Central to this rebuilding process will be the preservation of capital – can businesses retain cash that typically would have been tied up in either establishing or existing office space under the self-delivery model. Companies of all sizes will want to use this cash in a more constructive way – re-establishing supply chains, re-hiring etc – rather than burning through the process of signing leases on buildings for the long-term or having to sub-let to other firms.

The future operating models around workspace will be much more focused on the specifics of how much space is required, accurate assessment of utilization and the ability to flex those requirements up and down in accordance with headcount. But companies are going to want to move forward after a long period of remote working and getting them client-facing and collaborating in the most agile way possible will be key.

Historically, CRE has been the last bastion resisting full BPO transformation. The logic has always been that it’s ‘too complex’ and ‘illiquid’. The current situation will break both of those barriers and we can expect CFO’s to be looking at the cost/benefit of buying space as a service, not as a fixed asset/liability.

This is potentially the biggest shift in the office market in our lifetimes.