The Instant Group has released the 2019 US market summary, reporting on Instant’s findings on the growth of the US flexible workspace market.

The Instant Group examines the new players coming into the space; the trends of demand, supply, and occupation; and types and growth statistics in key states. Instant’s report is founded on the oldest and largest set of data in the market, with Instant taking a 20-year sector view and covering more centers in more locations than any other firm.

As the market continues to grow at pace, with many questioning “how far can this market go?”, Instant digs into the impact flex is having on the US commercial real estate market and how it’s very much here to stay.

The key findings in Instant’s annual market overview include:

- The US market is now the largest in the world with over 5,300 centers (beating out the UK!)

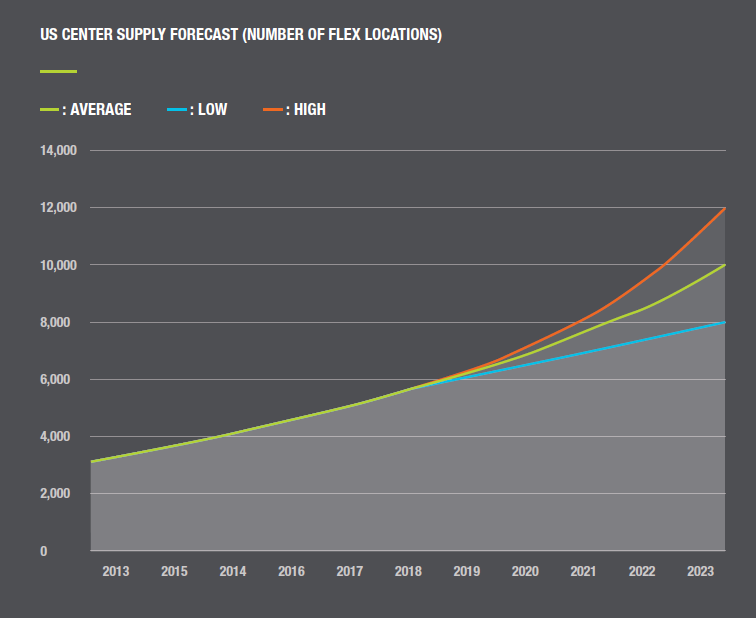

- We forecast 10,000 centers in the US by 2023

- The average size of a flexible center is 18,741 sq ft- seating anywhere from 180 people in large private offices to 450 coworking stations

- District of Columbia, Georgia and Ohio lead the way in year on year growth when looking at number of centers in Q1 2019 at 15%, 15% and 13% respectively

- California leads the way with the greatest number of centers at 1,100

- We are seeing a trend towards secondary markets across the US keeping in pace with wider societal trends and employment growth

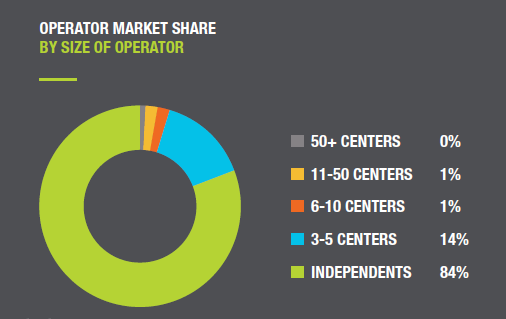

- 84% of the operators in the US run just one center; 14% run 3-5 centers and 2% own 6 plus showing that the market is diversifying, not consolidating

- Flex space makes up less than 1% of total office space across the entire US market

The U.S. market for flexible space is now the largest in the world

The US now has 5,300 flexible workspace locations, as of August 10, 2019, compared to 4,563 in the UK, despite being less than 1 percent of total office space across the entire U.S. market.

The Instant Group has seen supply not only increase by 10% year-on-year, but also morph from a start-up focused sector built up around core cities into one focused on providing solutions for more mature businesses across the U.S.

The market is diversifying, not consolidating

Despite large amounts of news coverage on leading flexible workspace providers such as IWG, WeWork, Knotel and Servcorp, to name a few, the flexible workspace industry remains a highly fragmented and complex industry, thanks to the entrepreneurial nature of many providers.

The 10 largest operators now make up 36 percent of the market in the U.S., which is less market share than they had in the prior 12 months.

Flexible offices grow by 50 percent based on size of centers opened in 2019

The average size of a flexible center in the U.S. is 18,741 square feet, which seats between 180 people in large private offices and over 450 workstations in a open coworking space. For locations opened in 2019, the average size increased to 28,526 square feet.

In New York, in particular, demand for 25 or more desks has increased from 6 percent to 13 percent in the last year. On the west coast, San Francisco demand for 10 or more desks has increased 27 percent from last year to 60 percent of total demand.

City by City

While New York City continues to lead the flexible market in the U.S. with over 500 locations, supply and demand vary by city.

San Francisco supply has increased 35 percent, while demand increased 7 percent; In Chicago, demand growth has increased 38 percent specifically on smaller requirements as the city finds wide start-up success; In Atlanta, demand increased by 27 percent with over 13 percent of companies looking for lease terms over 12 months; In Phoenix, 80 percent demand growth and vacancy rates decreased by 15.3 percent; and in Denver, demand increased by 50% while supply increased 5 percent. See here for chart.